Gifts of Insurance

A gift of your life insurance policy is an excellent way to make a gift to your designated charity. If you have a life insurance policy that has outlasted its original purpose, consider making a gift of your insurance policy to charity of your choice. For example, you may have purchased a policy to provide for minor children and they are now financially independent adults.

Benefits of gifts of life insurance

- Receive a charitable income tax deduction.

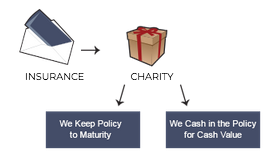

- If your designated charity retains the policy to maturity, you can receive additional tax deductions by making annual gifts so that they can pay the premiums.

- If your designated charity cashes in the policy, you will be able to see firsthand how your gift supports their charitable work.

- If your designated charity retains the policy to maturity, or you name them as a beneficiary, once the policy matures, the proceeds of your policy will be paid to a designated charity so that they can use the proceeds to further their charitable work.

How to make a gift of life insurance

To make a gift of life insurance, please contact your life insurance provider, request a beneficiary designation form from the insurer, and include your designated charity as the beneficiary of your policy.

You can also designate your chosen charity as a partial, full, or contingent beneficiary of your life insurance policy. You will continue to own and can make use of the policy during your lifetime. Your estate may benefit from an estate tax charitable deduction.

Your deduction for the gift of life insurance will depend on whether the policy has increased in value above the premiums and whether the policy is paid up or there are remaining payments to be made.